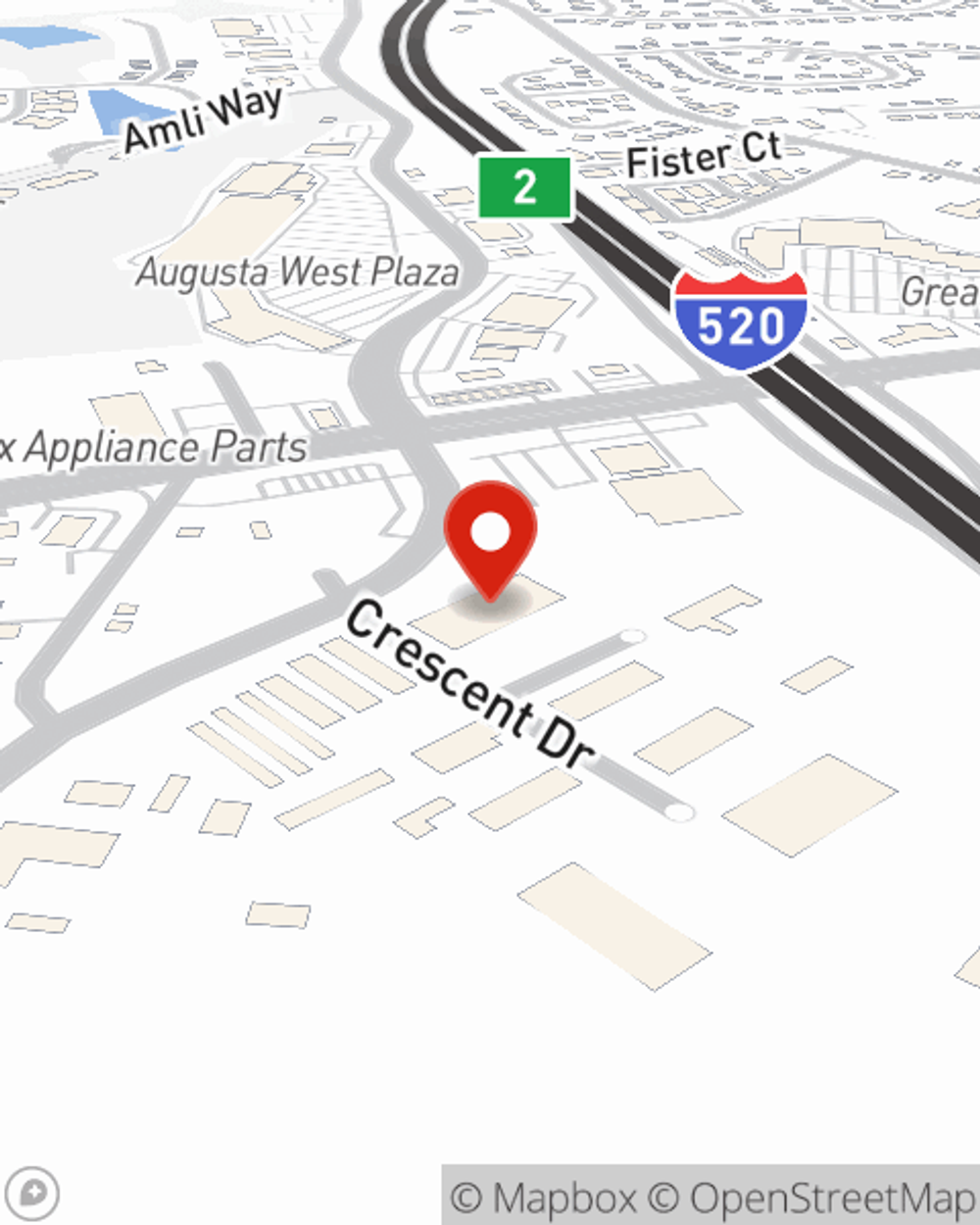

Business Insurance in and around Augusta

One of Augusta’s top choices for small business insurance.

Insure your business, intentionally

- Augusta

- Grovetown

- Evans

- Aiken

- North Augusta

- Martinez

- Hephzibah

- Waynesboro

- Appling

- Thomson

- Columbia

- Edgefield

Help Prepare Your Business For The Unexpected.

Small business owners like you have a lot on your plate. From inventory manager to customer service rep, you do everything you can each day to make your business a success. Are you a hair stylist, a piano tuner or a painter? Do you own a bridal shop, a pizza parlor or a toy store? Whatever you do, State Farm may have small business insurance to cover it.

One of Augusta’s top choices for small business insurance.

Insure your business, intentionally

Insurance Designed For Small Business

When one is as enthusiastic about their small business as you are, it is understandable to want to make sure everything is in order. That's why State Farm has coverage options for surety and fidelity bonds, artisan and service contractors, commercial liability umbrella policies, and more.

Since 1935, State Farm has helped small businesses manage risk. Contact agent Sammy Sanders's team to review the options specifically available to you!

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Sammy Sanders

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.